UltraTech Cement’s decision to enter the cables and wires (C&W) market has received mixed reactions from stock analysts. Some believe it won’t pose a major threat to existing companies in the early years, while others warn that the sector could face rating downgrades in the future.

Experts point out that the C&W industry is different from the paints sector. Unlike Grasim Industries, which had an advantage in the paint business due to its white cement presence, UltraTech Cement will have to build an entirely new distribution network for wires, which will take time.

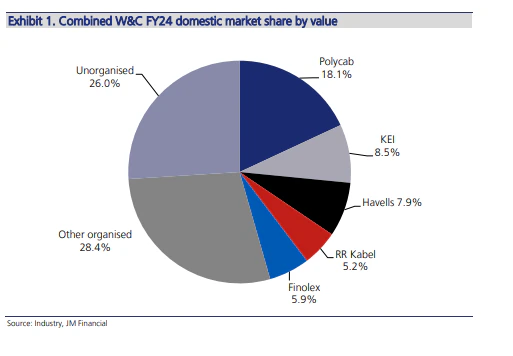

Currently, Polycab India holds the largest share in the cables market with 20%, followed by KEI at 12%, Havells at 8%, and KEC at 6%.

In the wires segment, Finolex leads with 15%, followed by RR Kabel at 12%, Polycab at 10%, V-Guard at 8%, Anchor at 7%, and Havells at 6%.

According to Nuvama Institutional Equities, UltraTech Cement’s entry into the cables and wires market is unlikely to have a major impact before FY28. Even then, its market share is expected to stay below 5% due to the industry’s fragmented nature, complex distribution system, and the need for approvals in the cables segment.

UltraTech Cement shares dropped 5.07%, hitting a low of ₹10,411.90 today, while stocks of Polycab India, Havells India, and KEI Industries fell by 9-10%.

Nuvama Institutional Equities believes UltraTech Cement’s entry won’t affect the earnings of cables and wires (C&W) companies between FY25 and FY28. However, they will keep an eye on any future announcements from UltraTech that could impact the demand and supply in the long run. Nuvama remains positive on KEI, Polycab, and Havells.

Meanwhile, MOFSL has lowered valuation multiples for C&W companies under its coverage—by 20% for Polycab India, KEI Industries, and RR Kabel, and by 10% for Havells India. The lower cut for Havells is due to its diversified product range and strong market potential.

MOFSL noted that UltraTech Cement might face a slight negative reaction initially, as investors have traditionally seen it as a cement-focused company.

The brokerage downgraded its ratings for KEI and RR Kabel from ‘Buy’ to ‘Neutral’ but kept Polycab India at ‘Buy’ and Havells India at ‘Neutral.’

According to CLSA, UltraTech Cement may prioritize wires over cables since wires have a quicker time-to-market and a stronger link to the housing sector. For the cables and wires industry to absorb the expansion plans of both existing players and new entrants, it would need to grow at an annual rate of 11-13% over the next 4-5 years.

Industry leaders are already planning to invest ₹10,000 crore in the next 2-4 years. However, if demand weakens, it could impact the sector’s profitability in the medium term, CLSA warned. The firm has maintained a ‘Hold’ rating on UltraTech Cement shares, setting a target price of ₹12,100.

JM Financial estimates that UltraTech Cement is aiming for revenue between ₹7,200 crore and ₹9,000 crore, depending on how quickly it scales up manufacturing and distribution. If the company reaches full-scale operations, it could capture around 5% of the C&W market by FY28, with a potential double-digit share in the wires segment.

Must Read – Tata Motors Shares Drop 9% to 52-Week Low Following Q3 Profit Decline