Tata Motors shares fell over 6% to a new 52-week low of ₹683.20 on the National Stock Exchange (NSE) after the passenger car manufacturer reported a 21.93% decline in net profit for the quarter ending December 31.

The stock price of Tata Motors reached a low of ₹683.20 per share following an opening value of ₹709.00, marking a decrease of 5.78% on the exchanges.

Currently, Tata Motors shares are trading around ₹703.40, reflecting a drop of 6.52%, which translates to a loss of ₹49.10 per share on Indian exchanges. The stock is attempting to recover, showing a 3.01% increase from its 52-week low.

In comparison to the same quarter last year, when the consolidated net profit stood at ₹7,145 crore, Tata Motors reported a decrease to ₹5,578 crore for Q3 FY25, representing a 21.93% year-over-year decline.

The company’s operating revenue saw only a modest increase of 2.7%, rising to ₹1,13,575 crore during the quarter from ₹1,10,577 crore in the same period last year. The slowdown in its Jaguar-Land Rover (JLR) business negatively impacted these figures.

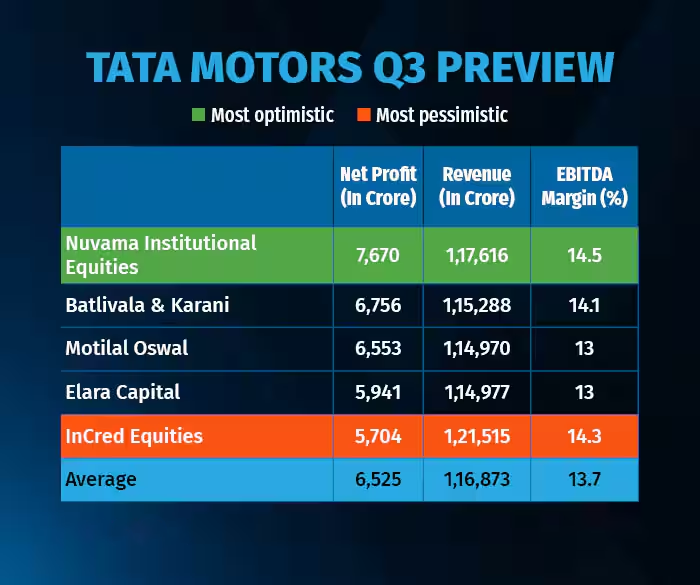

For Q3 FY25, Tata Motors recorded an operating profit (EBITDA) of ₹15,521 crore, a 1.9% decrease from the previous year. Additionally, EBITDA margins fell by 60 basis points to 13.7% from the prior year’s figures.

Segment-wise analysis for Q3 FY25 revealed that revenue from the passenger vehicles segment declined by 4.3% year-over-year to ₹12,354 crore in the December quarter. However, sales in the electric vehicle sector within this division grew by 19% annually.

The commercial vehicle (CV) segment also experienced an 8.4% drop in revenue compared to the same period last year, totaling ₹18,431 crore for the December quarter. Meanwhile, JLR’s revenue saw a slight increase of just 1.5%, reaching GBP 7.5 billion compared to the same quarter last year.